Best forex trading strategies and techniques

We all know that forex trading can be tricky to begin, but finding the right forex strategies to trade with is the key for beginner traders entering the forex market.

The forex market is the largest and most liquid financial market in the world. With an average daily trading volume of $6.6 trillion, more than double that of the New York Stock Exchange, making it an attractive arena for traders.

Trading currencies can be a rewarding endeavor for those who are willing to take on the risk. However, there are many pitfalls that beginners should avoid if they want to succeed long term.

That means finding the right trading style!

Continue reading to discover forex trading strategies that work and gain some insights into what you need to do as a beginner trader to be successful in the forex market. But first, understand exactly what a forex trading strategy is and how to choose the right one for you.

What is a forex trading strategy?

A trading strategy could be described as a set of rules that help a trader determine when to enter a trade, how to manage it, and when to close it. A trading strategy can be very simple or very complex - it varies from trader to trader.

Traders using technical analysis will find it easier to define their entry/exit rules, while traders utilising fundamental analysis might find it a bit more difficult as more discretion is involved. Regardless of that, every trader should have a strategy prepared, as this is the best way to achieve consistency and help you measure your performance accurately.

How to choose the best forex strategy?

Very few traders find the right forex strategy straight away. The majority will spend a significant amount of time testing various strategies with a demo trading account and/or backtesting. This allows you to conduct your tests in a safe and risk-free environment.

Even if a trader gets to the point where they find a strategy that has promising results and feels right, it is unlikely that they will stick with that exact strategy for an extended period of time. The financial markets are evolving constantly, and traders must evolve with them.

If you are a beginner, sticking with simple strategies might be preferable. Many beginners make the mistake of trying to incorporate too many technical indicators into their strategy, which leads to information overload and conflicting signals. You can always tweak your strategy as you go and use the experience you learned from backtesting and demo trading.

Most commonly used forex trading strategies for beginners

See our list of 12 effective forex trading strategies for beginners below:

- Price action trading

- Range trading strategy

- Trend trading strategy

- Position trading

- Day trading strategy

- Scalping strategy

- Swing trading

- Carry trade strategy

- Breakout strategy

- News trading

- Retracement trading

- Grid trading

1. Price action trading

Price action trading is a strategy that focuses on making decisions based on the price movements of a certain instrument instead of incorporating technical indicators (e.g. RSI, MACD, Bollinger Bands). There is a variety of price action strategies you could utilise - from breakouts and reversals to simple and advanced candlestick patterns.

Technical indicators generally are not part of a price action strategy, but if they are incorporated they should not play a large role in it but rather be used as a supporting tool. Some traders like to incorporate simple indicators such as moving averages as they can help identify the trend.

The benefits of price action trading are that your charts remain clean, and there is less risk of suffering from information overload. Having multiple indicators on your chart can send conflicting signals, which can lead to confusion, especially for beginners.

Reading the price action can also give you a better feeling for the market and help you identify patterns more efficiently. Another reason price action trading is especially popular amongst day traders is that it is more suitable for traders looking to profit from short-term movements. With day trading, you need to make decisions quickly, and having a "clean chart" and focusing purely on the price action will make this process easier.

Below is an example of a simple breakout trading strategy. 1.1772 was an important support level and our trader was waiting for a breakout to occur, so they could short EUR/USD to profit from the next leg lower. We can see that the overall trend is in their favour (downtrend). A breakout did occur and the currency pair fell more than 70 pips before eventually finding support at 1.1700.

Some traders prefer to enter as soon as the price breaks below the key support level (perhaps even with a sell-stop order), while other traders will wait to monitor the price action and take action later. False breakouts do occur frequently, so it is important to have appropriate risk management rules in place to deal with those.

2. Range trading strategy

Traders utilising a range trading strategy will look for trading instruments that are consolidating in a certain range. Depending on the timeframe you are trading on, this range could be anything from 20 pips to several hundred pips. What the trader is looking for is consistent support and resistance areas that are holding - i.e. price bouncing off the support area and the price being rejected at the resistance area.

Traders using this strategy must look for trading instruments that are not trending. To do so, you may simply look at the price action of the instrument, or use indicators such as the moving average and the average direction index (ADX). The lower the ADX value, the weaker the trend.

After you have found a suitable trading instrument, you must identify the range that the trading instrument is consolidating within.

A classic range trading strategy will tell you to sell when the price hits the area of key resistance and buy when the price hits the area of key support. Some traders will focus on two particular levels, while others will trade "bands" or "areas" - for example, if you identified 1.17 as the key resistance level but the price often stalls at 1.1690 or 1.1695, you can highlight that area (1.1690 - 1.17) and start looking for selling opportunities within it. Only focusing on that particular level might mean you will lose out on good trading opportunities, as prices can often reverse before hitting it.

Below is an example of a currency pair that is range trading (EUR/SEK). The ADX has low readings most of the time, and we can see that the price has often bounced off the 10.00/04 support area while having difficulties breaching the resistance area between 10.27 and 10.30.

3. Trend trading strategy

Trend trading strategies involve identifying trade opportunities in the direction of the trend. The idea behind it is that the trading instrument will continue to move in the same direction as it is currently trending (up or down).

When prices are consistently rising (posting higher highs), we are talking about an uptrend. Vice-versa, declining prices (the trading instrument is making lower lows) will indicate a downtrend.

Except when looking at the price action, traders can use supporting tools to identify the trend. Moving averages are one of the most popular ones. Traders might simply look at whether the price is trading above or below a moving average (the 200 DMA is a popular and widely watched one) or use MA crossovers.

To use moving average crossovers (which can also be used as entry signals), you will have to set a fast MA and a slow MA. One popular example is the 50 DMA and the 200 DMA. The 50-day moving average crossing above the 200-day moving average could indicate the beginning of an uptrend, and vice-versa.

Below is an example with the USD/JPY and two DMA crossovers (50 DMA & 200 DMA).

4. Position trading

The goal of position trading is to capture profits from long-term trend moves while ignoring the short-term noise occurring day to day. Traders that utilise this type of trading style might hold positions open for weeks, months, and in rare cases – even years.

Along with scalping, it is one of the more difficult trading styles. It requires a trader to remain highly disciplined, able to ignore the noise, and remain calm even when a position moves against them for several hundred pips.

Imagine for example, that you had a bearish outlook on stocks in early 2018. You shorted the S&P 500 at the beginning of the year, with the intention of keeping the position open for the rest of the year. While you would have enjoyed the price movements at the beginning and the end of the year, the rally from March to September could have been a painful experience. Only a few traders have the discipline to keep their positions running for such a long time period.

5. Day trading strategy

Day traders usually do not hold trades only for seconds, as scalpers do. However, their trading day also tends to be focused on a specific session or time of the day, when they try to act on opportunities. While scalpers might use an M1 chart to trade, day traders tend to use anything from the M15 up to the H1 chart.

Scalpers tend to open more than 10 trades per day (some highly active traders might end up with even more than 100 per day), while day traders usually take it a bit slower and try to find 2-3 good opportunities per day.

Day trading could suit you well if you like to close your positions before the trading day ends but do not want to have the high level of pressure that comes with scalping.

6. Scalping strategy

When scalping, traders are trying to take advantage of small intraday price moves. Some even have a target of only 5 pips per trade, and the trade duration could vary from seconds to a few minutes. Scalpers need to be good with numbers and be able to make decisions quickly, even when under pressure. They also usually spend more time in front of the screen and tend to focus on one or a few specific markets (e.g. only scalping EUR/USD or only S&P 500 futures).

The advantage of being a scalper is that it allows you to focus on the market in a specific timeframe, and you do not have to worry about holding your positions overnight or interpreting long-term fundamentals.

However, scalping comes with a lot of pressure as you need to be fully focused during your trading session. Furthermore, it is easier to make mistakes and react emotionally when your trades are running only for minutes. It may therefore not be the best trading style for beginners to start with.

7. Swing trading

Swing trading is a term used for traders who tend to hold their positions open for multiple days. They might use anything from a H1 to a D1 chart, or even weekly. Popular trading strategies include trend following, range trading, or breakout trading.

Traders who choose this type of trading style need patience and discipline. It might take days for a quality opportunity to show up, or you might end up holding a trade open for a week or more while running an open loss. Some traders do not have the necessary patience and close their trades too early.

If you like to analyse the markets without any rush and are comfortable with running positions for days or even weeks – swing trading might be the right trading style for you. It also gives you the opportunity to include fundamental analysis (trying to anticipate monetary policy moves or political developments) – which is futile to do when scalp trading.

8. Carry trade strategy

A trader using a carry trade strategy will try to profit from the difference in interest between the two different currencies that make up a currency pair.

A trader would go buy a currency with a high-interest rate and sell a currency with a low interest rate. A popular example is going long AUD/JPY (due to Australia´s historically high and Japan´s historically low interest rates). By doing so, the trader will receive an interest rate payment based on the size of their position.

The benefit of a carry trade strategy is that you can earn a substantial interest from just holding a position. Of course, you need the right market environment for this to work. If AUD/JPY is in a strong downtrend and you are holding a long position, the interest payments will not make up for the overall negative PnL.

Carry trades perform well in a bullish market environment when traders are seeking high risk. The Japanese Yen is a traditional safe haven, which is why many carry trades involve being short on the Yen against another "risk-on" currency.

However, you should also be familiar with the characteristics of the currency you are buying. For example, the Australian Dollar will benefit from rising commodity prices, the Canadian Dollar has a positive correlation with oil prices, and so on.

Below is a chart of the AUD/JPY and highlighted is a period when the currency pair was performing extremely well, and a carry trade would certainly have made sense.

9. Breakout strategy

A breakout strategy aims to enter a trade as soon as the price manages to break out of its range. Traders are looking for strong momentum and the actual breakout is the signal to enter the position and profit from the market movement that follows.

Traders may enter the positions in the market, which means they will have to closely monitor the price action, or by placing buy-stop and sell-stop orders. They will usually place the stop just below the former resistance level or above the former support level. To set their exit targets, traders may use classic support/resistance levels.

10. News trading

News trading is a strategy in which the trader tries to profit from a market move that has been triggered by a major news event. This could be anything from a central bank meeting and an economic data release to an unexpected event (natural disaster or geopolitical tensions escalating).

News trading can be very risky as the market tends to be extremely volatile during those times. You will also find that the spread of the affected trading instruments may widen significantly. Due to liquidity evaporating, you are also at risk of slippage - meaning your trade could be executed at a significantly worse price than expected or you may struggle to get out of your trade at the level you had in mind.

So now that you are aware of the risks, let's look at how you could trade the news.

First of all, you need to determine which event you want to trade and which currency pair(s) it will affect the most. A meeting of the European Central Bank will certainly impact the Euro the most. However, which specific currency pair should you pick? If you are expecting a hawkish ECB that will signal rate hikes, it would make sense to pick a low-yielding currency, such as the Japanese Yen. EUR/JPY could therefore be the right choice.

Furthermore, you can approach news trading either with a bias or no bias at all. It means that you have an idea of where you think the market might move depending on how the event unfolds. On the other hand, news trading without bias means that you will try to capture the big move regardless of its direction.

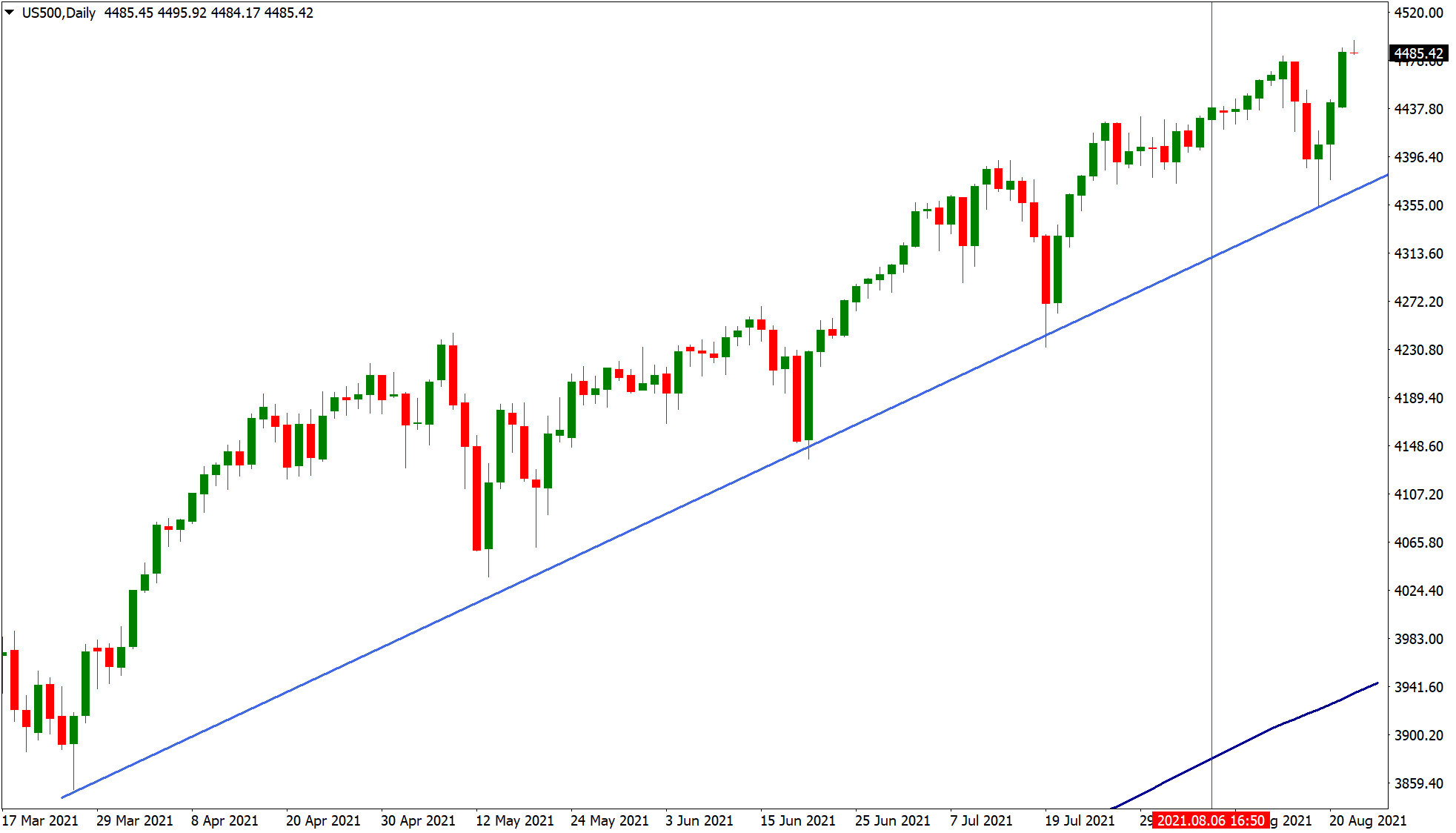

Below is an example of the impact the July NFP release had on the US500.

11. Retracement trading

Retracement trading includes temporary changes in the direction of a certain trading instrument. Retracements should not be confused with reversals - while reversals indicate a major change in the trend, retracements are just temporary pullbacks. By trading retracements, you are still trading in the direction of the trend. You are trying to capitalise on short-term price reversals within a major price trend.

There are several ways you can trade retracements. For example, you could use trendlines. Let's have a look at the chart of the US500 below. The index is in a clear uptrend and the rising trendline could have been used as a buying opportunity (once the price tests the actual trendline).

Fibonacci retracements are another popular tool to trade retracements - particularly the 38.2 %, 61.8 %, and 78.6 % levels.

12. Grid trading

Grid trading involves placing multiple orders above and below a certain price. The idea behind it is to profit from volatility by placing both buy and sell orders at regular intervals above and below the set price level (for example, every 10 pips above and below).

If the price moves in one direction, your position gets larger and so does your floating PnL. The risk is of course, that you will get false breakouts or a sudden reversal.

How to compare forex strategies?

Each trader should try to identify their own edge. This might be a set of skills that the trader possesses.

For example, some traders might have a short attention span but are quick with numbers and can handle the stress of intraday trading extremely well. Whereas a trader with a different trading style may not be able to function efficiently in this kind of environment, but could instead be a skilled strategist who can always keep sight of the bigger picture.

For beginner traders, it is especially important to identify what skills they may have and tailor the trading strategy according to each individual’s personality, not the other way around. There are many benefits of forex trading so it's up to you to compare the strategies which may be better suited.

How can you find out which FX trading strategy suits you?

Test them out in a demo environment with virtual funds. When you get a feeling about which one suits you the best, you can consider testing it out in a live environment. Not even then is the process finished.

Some traders might find day trading suitable for them, but then change to swing trading later in their trading career. Just as the market environment constantly evolves, so do traders and their preferences.

In addition to that, you can take one of the many free personality tests on the internet, which might provide you with further insights.

Ready to trade your edge?

Join thousands of traders and trade CFDs on forex, shares, indices, and commodities!

This information is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any trading strategy. It has been prepared without taking your objectives, financial situation, or needs into account. Any references to past performance and forecasts are not reliable indicators of future results. Axi makes no representation and assumes no liability regarding the accuracy and completeness of the content in this publication. Readers should seek their own advice.